Leveraging the power of Analytics in Finance Functions

Welcome to the next blog on Finance Analytics !

To maximize the potential of Advanced Analytics, organisations need to design an organizational structure that supports this mission. The companies have started to recognize the predictive power of Advanced Analytics, infact most of these are expecting to use AA to drive their business decisions and strategies. Inspite of the fact that most companies understand the importance of analytics and have taken steps to adopt common best practices, not even 20%, according to a recent McKinsey survey, have really utilized the potential and achieved AA at scale. In this Blog, we will understand as to how, Analytics can help achieve Strategic Mission and Objectives of an organisation.

Big Data is an emerging concept in almost all industries for different business functions. Finance function can get leverage from Analytics. It can help Finance Functions leverage the power of data analytics and deliver much more beyond accurate financial statements and reports. It can provide support to finance by delivering forward-looking, predictive insights that can help management shape their business strategy, control its strategy execution by taking ownership of organisational data and improve day-to-day decision-making in real time.

Finance and Accounting Activities are the tasks that are undertaken by accountants and financial planners financial or management accounting on short term and long term basis. Although, the nature and scope of financial accounting and financial management is not same for all the companies, it depends on size, capacity, structure and scope of business. However, there is some common criterion which are followed in companies of a particular industry or particular size. Basically, we proclaim a list of three activities in financial accounting as is given by Horngren:

(1) Bookkeeping – this includes incl. accounts payables, receivables, and credit management

(2) Statutory reporting, and

(3) Consolidation.

If we consider management accounting, it can also be set up differently in different organizations, but there are four core activities that are common to all, as described by Blocher and Brands and Holtzblatt –

1) Strategic Cost management,

(2) Performance measurement,

(3) Planning and decision making, and

(4) Support in financial statement preparation.

The rationale for using Business analytics for finance functions lies in a list of six endogenous elements comprehended by Holsapple

(1) Achieving a competitive advantage,

(2) Support of strategic and tactical goals,

(3) Better organizational performance,

(4) Better decision outcomes,

(5) Knowledge production, and

(5) Obtaining value from data

So a better organization performance in terms of bookkeeping, maintaining accounts payable and monitoring accounts payment can be achieved from an analytics integration of the accounting and finance functions. Analytics can help in categorising, picking and thereby contacting the right customer, which can improve collections / cash flows. And when it comes to fraud detection, prediction of bankruptcy, or default prediction of creditors , improving organisational performance in terms of statutory reporting and compliances, analytics can provide a huge potential.

The combination of financial accounting data and business analytics was mostly used in the narrower sense and that too only from an external perspective on the company. Finance department, in an organisation, needs to step in and support the company strategy as well which gets limited due to several constraints on funding and headcount and, secondly, provide the organization with information analysis in terms of funding, budgeting, utilisation and analysis.

So Finance Analytics (FA) can act as a Strategist, Catalyst, Steward and Operator of an Organisation. As a strategist, FA can influence organisational strategies such as Investment Management Strategy, Planning and Budgeting Strategy and Asset Management Strategy. When Analytics is designed to help Finance bring changes such as Cost Management, Customer & Revenue Analysis or Operational efficiency, it acts as a catalyst. Designing Analytics to preserve the assets of organisation through Internal Control Analytics and Risk Management Analytics makes it a steward. Acting as an operator, it is designed to manage financial processes such as Payables, Receivables, Consolidation and Reporting frameworks.

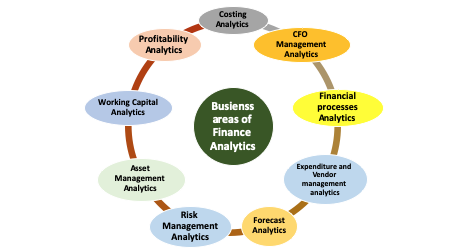

Finance Analytics can improve the control function of Finance and providing decision support throughout all business areas by providing area specific solutions. A few are being discussed henceforth –

- Costing Analytics

- Financial Processes Analytics

- Forecast Analytics

- Expenditure and Vendor Management Analytics

- Financial Processes Analytics

- Risk Management Analytics

- Profitability Analytics

- Asset and Investment Management Analytics

- Working Capital Analytics

- CFO Management Analytics

For more insights about the basics of Finance Analytics, you may refer to following sites :-

Keep reading & enjoy this and further posts of mine on Finance Analytics.

Have a great time!

Ms. Rachna Kathuria

Associate Professor

JIMS Kalkaji